Complete Data Solution for Structured Bond Professionals

We provide solutions for managing structured bond data across the full lifecycle, covering all structured bond formats—including Uridashi, Samurai, and Private Placement bonds. Our platform supports bond issuers and financial institutions with efficient data management, strong data governance, risk analysis, and an automated pricing workflow.

Managed Data Statistics

High Quality Bond Data

Majority of Uridashi bonds are either a complex structured product or in foreign currency. Our bond data, input and double-checked by experienced professionals, provides you with every useful detail of such bonds. Fixings, redemption status and verious analysis is recalculated daily throughout the lifetime of the bond.

Structured Bonds Market Analysis

Do you know expected redemption amount this month if Nikkei move 10% above current spot? Which FX underlying has biggest long-term exposure? Imperial Market Data has answer to every questions on Uridashi providing both numerical data and charts. We inform you every morning with latest issuance and market activities through e-mail.

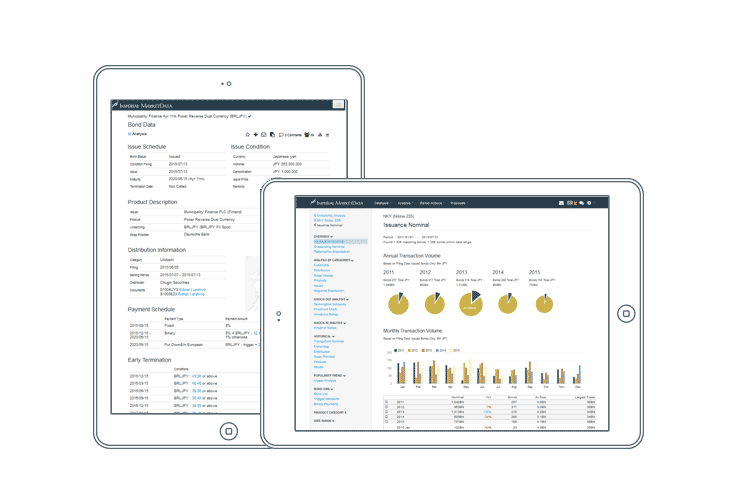

Business Optimized

Imperial Market Data is focused on providing users with simple, fast and intuitive interface to reach your target information. You can access multi-device, including PC, tablet and your mobile phones. You can use our API to directly access our Uridashi database from your Excel or internal applications. All data is provided in both English and Japanese.